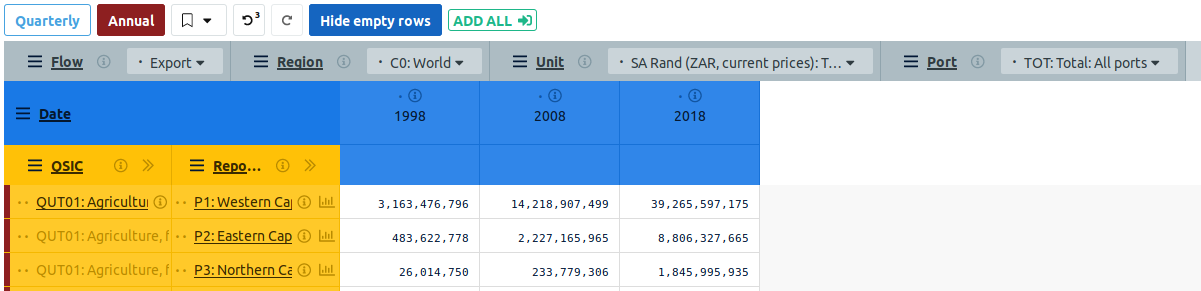

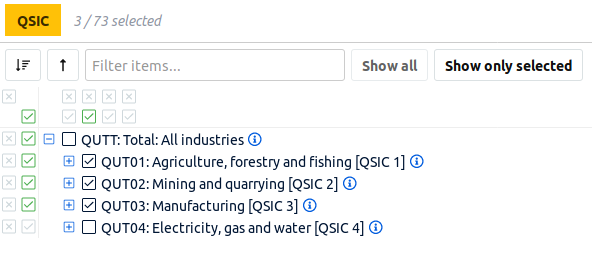

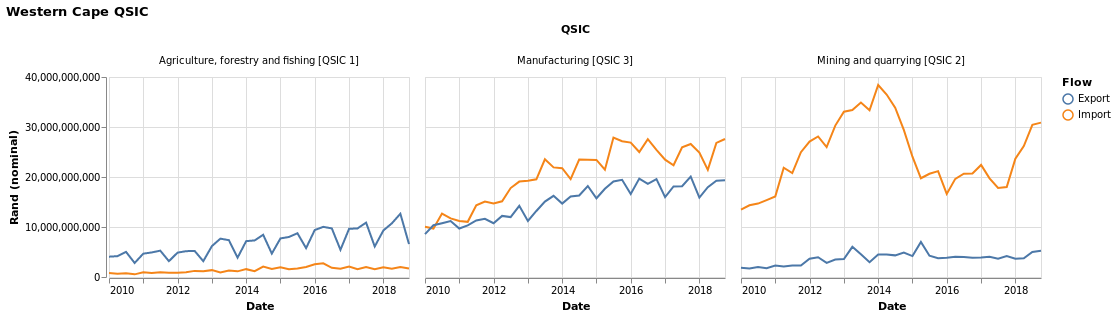

At Quantec we provide South African regional trade data, as part of our EasyData Trade Service. In this blog post, we will be focusing on our data set, RSA Regional Trade QSIC (TRD11).

The purpose of this post is to introduce TRD11, and to show how it could be used to visualise and analyse South African regional trade data. The visualisations in this post have been coded in Python—using the Pandas and Altair libraries. For those who are interested, the code will be made available on GitHub.

Take note, it is not the intention to draw any conclusions from the data in this post, but merely to show what is available.

![Fig 4: Western Cape trade [Agriculture, Fishing, Forestry]](/media/20e7ae1f/ffdb46dc56708f2425e18feb209c6d54.png)

![Fig 5: Western Cape trade / Exports [Mining]](/media/20e7ae1f/05d39cca31a1e45dbe2352fc8c2b30cd.png)

![Fig 6: Western Cape trade [Mining and quarrying without Crude oil and natural gas]](/media/20e7ae1f/b3d58f302c3a4a7301965e644efe1f01.png)

![Fig 7: Western Cape trade [Manufacturing]](/media/20e7ae1f/08d5815d4f193ce43cce7beba606deca.png)

![Western Cape top import products from Namibia in 2018 [HST 6-digit]](/media/20e7ae1f/41831398235c52e353f2a132a4324347.png)

![Western Cape top export commodities to the Netherlands in 2018 [HST 6-digit]](/media/20e7ae1f/d3a125afadc231bbfbe677efa3376147.png)