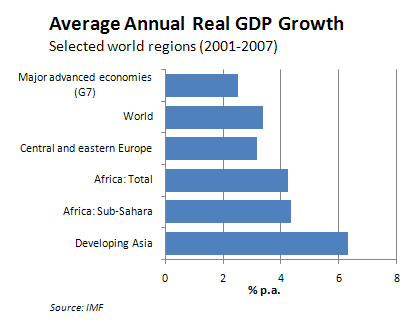

The past seven or eight years have generally been good in terms of economic growth for most African economies. Ironically, the pickup in economic growth over the past five years to around 5% overall for Africa, happened after The Economist magazine labeled Africa "the hopeless continent" in an article in 2000.

The reason for the relatively high economic growth has had much to do with the sharp escalation in commodity prices, although some countries have also made advances in diversifying their economies and have consequently become more competitive in general. However, the extent to which Africa had fallen behind during nearly four decades of economic stagnation pre-2000 while most of the rest of the world progressed in leaps and bounds, becomes clear if per capita output numbers are analyzed. In 2006, per capita GDP levels in Sub-Saharan Africa were only back at their 1980 levels. In fact, Sub-Saharan real GDP per capita in 2006 was only 19% of the world average, compared with the 29% that prevailed in 1980. Real GDP per capita growth in Sub-Saharan Africa averaged 0.0% p.a. during 1980 to 2006, compared with average growth rates of 6.6% recorded in East-Asia/Pacific, 3.7% in South Asia, and 1.8% for the World as a whole. Even Latin-America managed 0.7% growth in per capita GDP over the period.