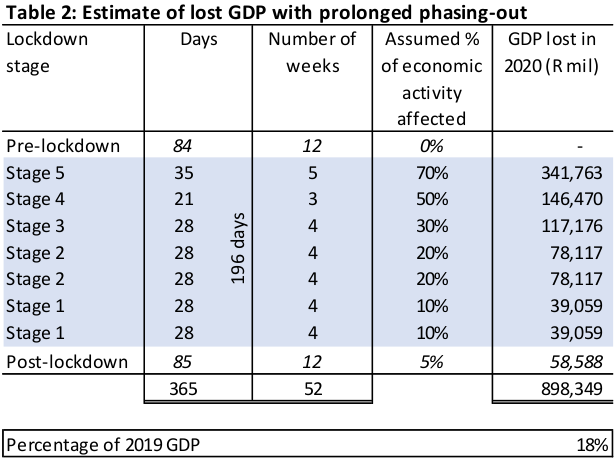

After more than a month of some of the strictest lockdown measures imposed by any country, the jury is still out on whether we have seen the worst of the coronavirus epidemic, or whether the worst effects of the disease are still to come for South Africans. But what is certain, is that the economic impact of the government measures imposed thus far and still envisaged for the near future, will be quite severe.

Lockdown impact severely affecting businesses

On 21 April, Stats SA published the results of a survey of 707 businesses [1], attempting to measure their implemented and expected future actions due to the lockdown, as well as their experience thus far and foreseen impact of the ceasing of most sales, services, production and international trade. The following is a summary of the findings:

- 85.4% of responding businesses reported turnover below the normal range

- 46.4% indicated temporary closure or paused trading activity

- 50.4% expected their workforce size to stay the same in the two weeks after the survey

- 36.8% reported that their workforce size is expected to decrease

- 28.3% indicated that they decreased working hours

- 19.6% reported staff being laid-off in the short-term

- 19.1% indicated that prices of materials, goods or services purchased increased more than normal

- 23.8% indicated a decrease in access to financial resources, while 52.6% indicated access to financial resources remaining the same

- 38.2% of businesses applying for financial assistance reported that they would use government relief schemes

- 30.6% indicated they can survive less than a month without any turnover, while 54% can survive between 1 and 3 months only

- 46.3% of the workforce were able to meet business demands, and 43% of the workforce were not able to meet business demands (the rest reported being unsure)