The South African passenger vehicle market faces several key challenges over the coming months. Most notable amongst them is our current GDP growth outlook. The South African economy only recorded a GDP growth rate of 0.9% in the first quarter of this year. In addition, the International Monetary Fund (IMF) recently revised their 2013 GDP growth forecast for South Africa down, from 2.8% to 2%. New CO2 emission taxes on vehicle sales and increasingly indebted South African consumers also add to concerns. Furthermore, although the current interest rate environment still supports new vehicle sales, this may change in the future. Factors including a weakening Rand, electricity and fuel price hikes and high wage demands are all contributing to higher long-term inflation and may force the South African Reserve Bank to act. An increase in interest rates will force cash-strapped consumers to reassess their expenses and vehicles sales will suffer as a result.

Bumpy Road Ahead

July 15, 2013

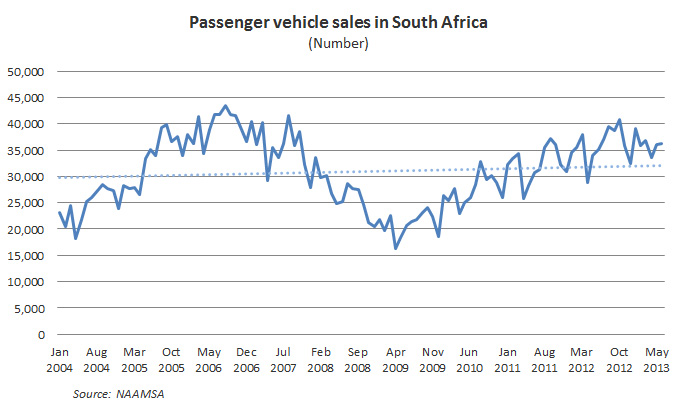

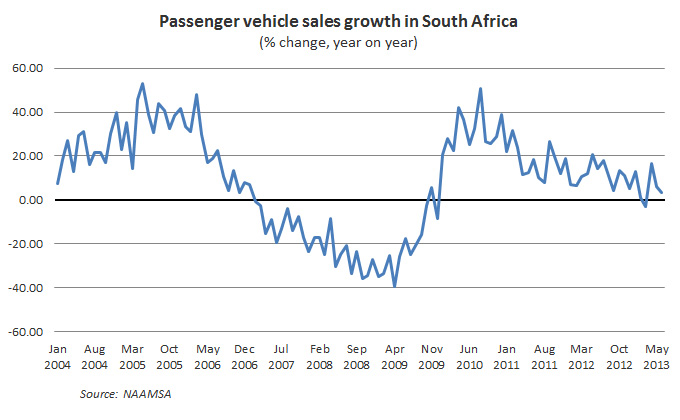

A closer inspection of the data offers a more mixed outlook. While Figure 1 reveals that passenger vehicle sales numbers are continuing on an upward trend following the 2008-2009 economic crisis, Figure 2 reveals that year-on-year monthly vehicle sales appear to be slowing.

Another important point to note is that a portion of vehicle sales leading up to April 2013, the commencement point of the CO2 emission taxes, may be the result of forward planning by savvy individuals and not down to the general health of the passenger vehicle market. If this assumption is accurate, passenger vehicle sales may initially dip more than expected before returning to a passive growth path. Alternatively, some consumers may purchase vehicles with smaller carbon footprints, thereby avoiding emission taxes but contributing less to the Rand value of new vehicle sales.

All is not lost however; the National Association of Automobile Manufacturers of South Africa (NAAMSA) cites current low interest rate levels, high replacement demand, ongoing incentives and new model introductions as bright spots in an otherwise difficult trading environment. At the same time, the IMF expects South African GDP growth to rise to 2.9% in 2014.

Political and economic developments and perhaps even the initiation of controversial e-toll tariffs in the coming months will play a big part in determining the performance of the passenger vehicle market in South Africa.

Anthony Spyron

Economist, Quantec

Quantec News

About Quantec

Quantec is a consultancy providing economic and financial data, country intelligence and quantitative analytical software.

Recent news

New Exciting StataNow Features! - 13 Nov 2025

Stata's Upcoming Free Specialised Webinars - 25 Sep 2025

Stata's New Power Logistic Command - 26 May 2025

Stata Specialised Webinars in June, July and August - 15 May 2025

Construction Materials Suppliers - April 2025 - 06 May 2025

Stata 19 is here! - 10 Apr 2025