A ‘rollercoaster heading downhill’ that needs to ‘level out’, soon! The impact and prospects of economic and fixed investment trends on the Construction Materials Suppliers

‘Demography is destiny’, credited to French philosopher Auguste Comte (1798-1857), encapsulates a great deal about the dynamics of our economy, construction sector and the suppliers to the latter. There are many nuances to the saying, but in our context, what is available per person, or gross domestic product/income per capita holds the key.

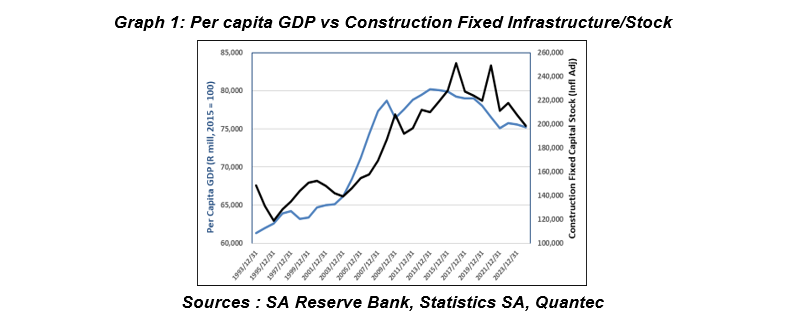

The logic is straight forward; total production/income in the economy divided by the population. The size of the country’s production/income is an indication of its wherewithal to afford infrastructure (houses, hospitals, roads etc.) for its people, and the number of people is an indication of the needs of the population. Graph 1 shows the correlation between GDP/per capita and the size of ‘construction’ infrastructure.