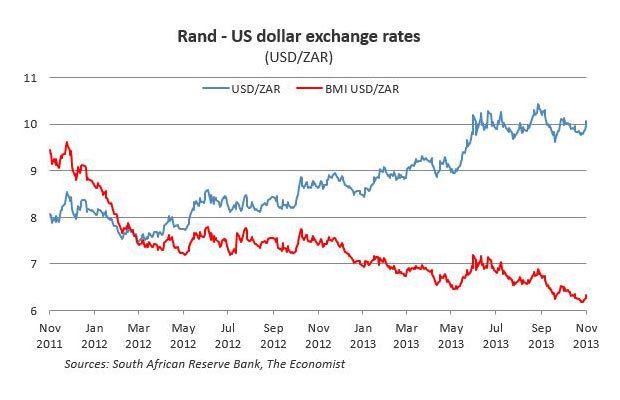

Since May 2013, with the threat of electricity supply shortages, labour unrest and other political risks spooking markets, the rand has depreciated by 11% to around R10 to a US dollar. In all fairness, the rand’s decline can also partly be blamed on lingering global economic risks. Emerging market economies are constantly alternating between being viewed as suitable, and just as quickly, unsuitable investment destinations, depending on global market moods. But is the rand really only worth one tenth of a US dollar? A simple tongue-in-cheek glance at the Big Mac Index may provide a rough guide.

The Big Mac Index, first published by The Economist in 1986, has become a globally recognised PPP or purchasing power parity indicator. PPP theorises that a long run exchange rate will always move to a level that equalises the price of an identical good in any two countries. In the case of the Big Mac Index, this good is a McDonald’s Big Mac. The Big Mac’s suitability as a benchmark is born from its ability to be completely standardised across countries and continents.

Criticism of the Big Mac Index

Although the Big Mac Index is widely monitored and reported, many Burgernomics sceptics still question the theoretical foundation of the Big Mac Index. They argue that burger prices would naturally be cheaper in poorer countries due to lower labour costs. Exchange rates obtained using the Big Mac Index are therefore biased and do not reliably provide current fair value for currencies. In addition, a burger contains only a fraction of the goods purchased in a country or traded between countries, so the “burger basket” is rather small.

However, Burgernomics is not totally off the menu. The Economist also publishes an adjusted Big Mac Index, which has proved more palatable amongst Burgernomics patrons. The adjusted index accounts for labour cost concerns by using the “line of best fit” between Big Mac prices and GDP per capita in each country, providing a better measure of current fair value.

What does the Big Mac Index say about the rand?

As indicated in Figure 1, and according to the adjusted Big Mac Index, the rand is becoming increasingly undervalued against the US dollar. Taking today’s real exchange rate into account, the current fair value of the USD/ZAR exchange rate is R6.47. Similarly, current fair value for the EUR/ZAR exchange rate is R7.80, for the GBP/ZAR rate it is R10.75 and for the JPY/ZAR rate it is R0.0923.